Canada Grocery Rebate Payment 2025: Grocery rebate program is very popular in Canada as it has given a one time benefit to all the citizens in Canada who were earning a very low income. Millions of Canadians are again waiting to check their Canada new grocery rebate payment 2025. The government has updated the portal for grocery rebate payment in 2025.

Canadians are required to check the new updates regarding the CRA Grocery Rebate Payment 2025 which are discussed in this article. You will also know about the Grocery rebate eligibility 2025 Canada, payment rates and other information of the program for Canada Grocery Rebate Payment 2025.

Canada Grocery Rebate Payment 2025

The Grocery Rebate Payment program in Canada was announced by the Canada revenue agency in 2023 and is not revised frequently to canadians. It was a one time payment program which has provided a Maximum benefit of $628. The country was facing an inflation and cost of living hike increment in 2023.

So government had provided a one time extra benefit to canadians who are paying the tax to the government without any delay. But now the payment is not revising in 2025 and it has been discontinued by the authority after releasing the Canada one time benefit of the Grocery inflation relief Canada program on 5th July 2025, the new payment will be out soon further.

$2970 Direct Deposit in July 2025: Social Security, Tax Refund, Stimulus Explained & Payment Date

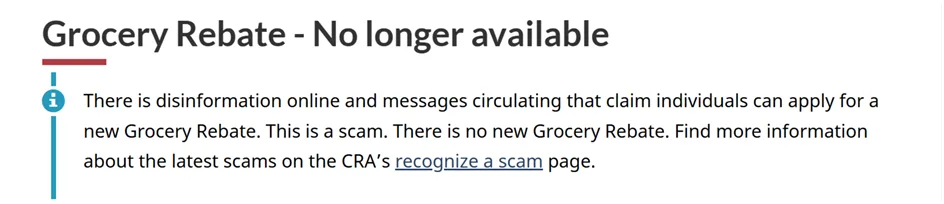

So until you hear new announcement from the Government of Canada for grocery rebate then you should not believe on circulating news on social media regarding the payment of grocery rebate canada.

Grocery Rebate Payment 2025 Official Announcement

The Government of Canada has officially announced that they are not revising the Grocery Rebate Payment in 2025.

The grocery debate program was introduced in the financial budget of 2023. Since the Canada revenue agency is releasing the monthly and quarterly benefits to canadians in the country’s citizens are believing to get grocery rebate again, but it is not true.

Apart from this, the government have also discussed in the potential of scam regarding Grocery rebate program in Canada. So while reading any news on social media for grocery payment then you should avoid telling confidential details on these websites as they can use your details to make a scam.

Who Qualifies for Grocery Rebate Canada?

The Canada revenue agency has listed detailed eligibility criteria to release the benefit of grocery rebate program in the country, you can check the following Grocery rebate amount eligibility criteria in this section:

- Canadians are required to live in a country for a long time for more than 10 years with permanent citizenship of Canada.

- It is important to pay the tax to the government before the deadline to receive the benefit of the grocery rebate program.

- The applicant is required to register for the GST / HST credits benefits, as if you are already eligible for such benefits then the payment for the grocery debate will automatically be refunded in your account.

Low-Income Grocery Subsidy Canada Payment Date

Canada revenue agency released the payment of grocery rebate program on 5th July 2023 in bank account open beneficiaries. The payment was released along with the GST and HST credits in the country.

However, the quarterly benefits of the GST and HST are also schedule on October, January and April, but the payment for grocery rebate is not released in upcoming dates. However it was the last payment of grocery rebate on 5th July 2023, and after that the government did not make any payment for this program.

How to Claim Canada Grocery Rebate 2025 Payment?

There are many programs in Canada which are managed by Canada revenue agency where applicants are required to submit the application manually and complete the verification through documentation and other procedures.

But there was no application form for grocery rebate program in Canada as already registered candidates with GST and HST credit were automatically listed in the beneficiaries of the grocery rebate program.

Canada Grocery Rebate Payment Method

The rebate will be credited just like your regular GST/HST credit:

Direct deposit: If the CRA has your banking information on file, the payment will be electronically deposited into your account. This is the fastest and most secure method.

Paper check: If you haven’t set up a direct deposit arrangement, the CRA will mail a check to your registered address. This method takes longer and carries a higher risk of delays or lost mail.

Canadian Food Inflation Rebate Scam

There are many scams running on where most of the seniors are targeting in this scam. There are running multiple campaigns on social media platform including Facebook, WhatsApp and search engines. They are sending fake links to the canadians on their personal contact and asking them to enter MY CRA User id and password and other details for verification.

$1395 GIS Boost in July 2025, Who Qualifies and How to Claim GIS Boost?

$1,200 + $2,800 OAS & CPP Payments Boost in 2025, Who Qualifies for the $4,000? Key Dates

These details are very confidential and it can be used for getting loan for other transaction from organisations in Canada. So if you are also getting such news for fake link then should not open it in your device and it does not provide your details to search scammers as the grocery rebate program is not part of federal schemes and was only introduced in financial budget of 2023.

Frequently Asked Questions :-

What if I don’t receive my payment?

If you think you are eligible but don’t receive your rebate on time, contact the CRA directly through their official channels. Have your Social Insurance Number and recent tax return information ready.

Can I get Canada Grocery Rebate if I am temporarily living outside of Canada?

You must be a resident of Canada for tax purposes. Temporary absences cannot disqualify you, but extended periods of stay abroad may affect your eligibility.

What if my family situation changes between filing your 2023 return and July 2025?

The rebate amount is based on your 2023 tax return information. Changes in family composition after filing will not affect your grocery rebate amount, although they may affect future GST/HST credits.