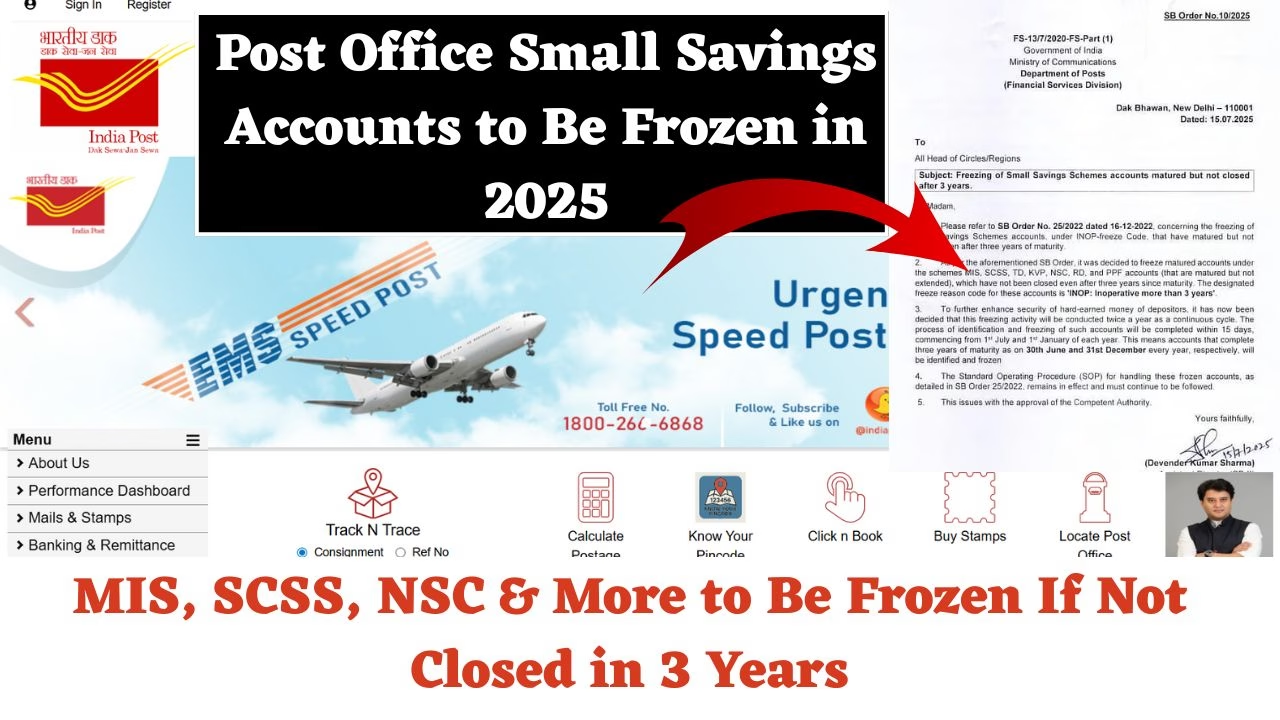

Post Office Small Savings Accounts to Be Frozen in 2025: The Department of Posts recently said that some savings accounts that have reached their maturity date and have not been closed or renewed within three years will no longer be active. In order to protect depositors’ hard-earned money, it recently issued an order requiring account freezing to be a routine process that is carried out twice a year to identify such accounts.

Small savings plan holders should be informed that their accounts will be locked if they do not liquidate them within three years of the plan’s maturity.

Post Office Small Savings Accounts to Be Frozen in 2025?

The Department of Posts stated in a directive dated July 15 that the following post office small savings initiatives are covered:

- The MIS, or Monthly Income Scheme

- The SCSS, or Senior Citizens Savings Scheme

- The Time Deposit (TD)

- KVP, or Kisan Vikas Patra

- Certificate of National Savings (NSC)

- RD, or recurring deposit

- Public Provident Fund (PPF), if it isn’t renewed after death

What happens to an account that is frozen?

All activities, including withdrawals, deposits, standing orders, and online services, are halted when a post office small savings account is frozen after it matures. On July 15, 2025, an order was issued stating, “It has been decided that this freezing activity will take place twice a year as part of a continuous process to better protect depositors’ savings.”

Starting on July 1st and January 1st of each year, the process of identifying and freezing such accounts will be finished in 15 days. This implies that accounts that reach their full three-year maturity on June 30 and December 31 of each year, respectively, will be recognized and frozen.

How can I have my small savings plan account unfrozen?

Account holders must provide the necessary paperwork to the relevant agency in order to reactivate or unfreeze their accounts. This is the procedure to activate inoperative accounts that have been matured for more than three years but have not been closed within the three-year period and the cut-off date, as per SB Order No.2512022, dated 16-12-2022.

For closure, the accountholder needs go to any post office and turn in the required paperwork:

a) The frozen account’s passbook or certificate

b) KYC documents, including proof of address, PAN card, mobile number, and Aadhaar.

c) Account Closure Form (SB-7A): In order to credit the maturity value into his or her savings account, the account holder must also submit the account closure form, passbook, and information about their bank account or post office savings account number, as well as a cancelled check or copy of their passbook. To verify the authenticity of the account holder with pertinent records, the department will first verify the depositor’s details and tally the signature.

The relevant certificate or account will unfreeze the accounts once the authenticity of the case has been confirmed. Through ECS outward credit, the maturity value will be credited to the account holder’s bank account or post office savings account.