$30–$100 Social Security Payments Cut in July 2025: If you’ve noticed your Social Security payment was $30–$100 lower in July 2025, you’re not alone. Millions of beneficiaries across the U.S. — including retirees, SSDI recipients, and low-income seniors — are experiencing an unexpected dip in their monthly payments. This change is triggering concern, $30–$100 Social Security Payments Cut in July especially among those who rely on Social Security as their primary source of income.

This article will explain exactly why these reductions are happening, who is impacted, how to check your benefit status, and what you can do if your Social Security income has dropped. We’ve also included updated July–August 2025 payment dates and answers to the most frequently asked questions.

Why Are Social Security Payments Reduced in July 2025?

The $30–$100 Social Security Payments Cut in July drop in Social Security checks this month isn’t random. The Social Security Administration (SSA) has cited a combination of factors — many of which are triggered by income changes, benefit recalculations, or administrative enforcement.

1. Medicare Premium Adjustments

If you’re enrolled in Medicare Part B or Part D, your monthly premiums are usually deducted directly from your $30–$100 Social Security Payments Cut in July check. In July 2025, many seniors saw their benefits decrease due to:

- Retroactive premium increases

- 2023 tax return reviews that raised their income brackets

- Income-Related Monthly Adjustment Amounts (IRMAA) applied for higher earners

2. Tax Withholding Updates

The IRS may have revised your federal income tax withholding based on updated income data or changes in your filing status. If you didn’t update your Form W-4V, the IRS might automatically adjust the amount withheld, reducing your net $30–$100 Social Security Payments Cut in July payment.

- You may have also requested a higher withholding rate last year and forgotten.

- Recent RMDs or investment income may have changed your overall tax picture.

3. SSA Overpayment Recovery Efforts

The SSA is cracking down on overpayments that were made in error—sometimes dating back years. You may have received too much in past months or years, and the SSA is now recouping the excess by:

- Deducting small amounts ($30–$100 or more) from your monthly benefit

- Withholding full payments for several months (in rare cases)

- Sending repayment demand letters

4. Treasury Department Garnishments

The Treasury Offset Program can legally garnish Social Security payments for unpaid federal debts, including:

- Delinquent student loans

- Back child support

- Unpaid federal taxes

With updated enforcement starting in July 2025, some garnishments have resumed or increased, reducing monthly checks for those affected.

Who Is Affected by the July 2025 Payment Cuts?

Not all Social Security recipients are seeing reductions. The affected individuals typically fall into specific categories:

| Beneficiary Group | Reason for Reduction |

| Retirees aged 62+ | Medicare premium updates or overpayment recovery |

| SSDI (Disability) recipients | Tax withholding or repayment of excess disability checks |

| SSI beneficiaries | Mostly unaffected unless overpaid in past months |

| Higher-income seniors | IRMAA-related Medicare increases |

| Recipients with federal debt | Garnishments from Treasury Offset Program |

| People with pending appeals | Temporary payment adjustments during SSA reviews |

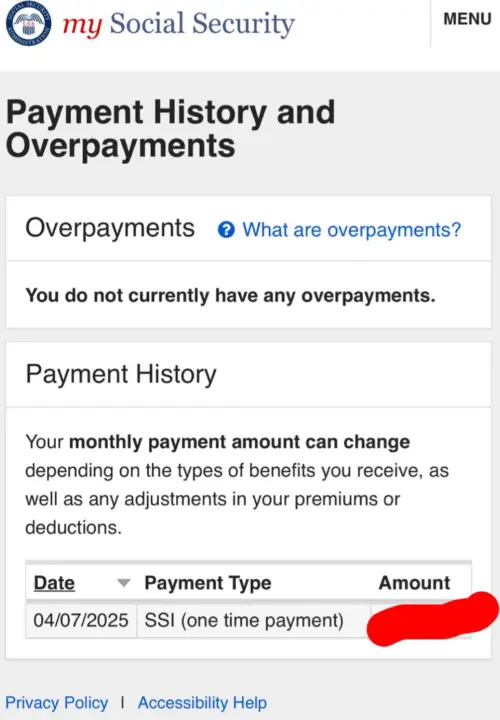

How to Check If Your Social Security Payment Was Reduced

To understand exactly why your benefit was reduced, follow these steps:

Step-by-Step Guide:

- Log in to your SSA My Account: ssa.gov/myaccount

- Click on “Payment History” and select July 2025

- Review your Medicare deductions, federal tax withholdings, or overpayment notes

- Check the Message Center for official SSA notifications

- If still unclear, call the SSA at 1-800-772-1213

July–August 2025 Social Security Payment Dates

Stay on top of your benefit payment schedule to track any changes and ensure you receive your funds on time.

| Birthday Range | July Payment Date | August Payment Date |

| 1st – 10th | Wednesday, July 10 | Wednesday, August 14 |

| 11th – 20th | Wednesday, July 17 | Wednesday, August 21 |

| 21st – 31st | Wednesday, July 24 | Wednesday, August 28 |

| SSI Recipients | Thursday, August 1 | Friday, August 30 |

Will the Payment Cut Continue After July 2025?

Whether the reduction continues depends on the underlying cause:

| Reason | Will It Continue? |

| Medicare premium updates | Yes, likely through end of 2025 unless you qualify for help |

| Tax withholding | Until you change your W-4V election |

| Overpayment recovery | Until full repayment is made or a waiver is approved |

| Garnishments | Continues until debt is cleared or a payment plan is arranged |

What to Do If Your Social Security Check Was Reduced

If your check is smaller, don’t panic—but do take action immediately:

1. Contact the SSA

- Visit your local SSA office

- Call the SSA helpline (1-800-772-1213)

- Ask about a repayment appeal, waiver, or installment plan

2. Update Medicare and Tax Preferences

- Adjust Form W-4V to lower tax withholding

- Apply for Medicare Savings Programs (helps reduce premium deductions)

3. Request a Hardship Waiver

If the deductions cause you financial stress, complete Form SSA-632-BK to request relief from repayment.

4. Explore Other Support Programs

You may qualify for additional help, including:

- SNAP (Food Stamps)

- LIHEAP (Energy Assistance)

- Medicare Extra Help (Part D drug plan support)

- State-run rebate programs for rent or utilities